QuickBooks Integration

Integrate your DonorSnap database with your QuickBooks Online or QuickBooks Desktop account.

Enter Your Data Once and Automatically Transfer to QuickBooks

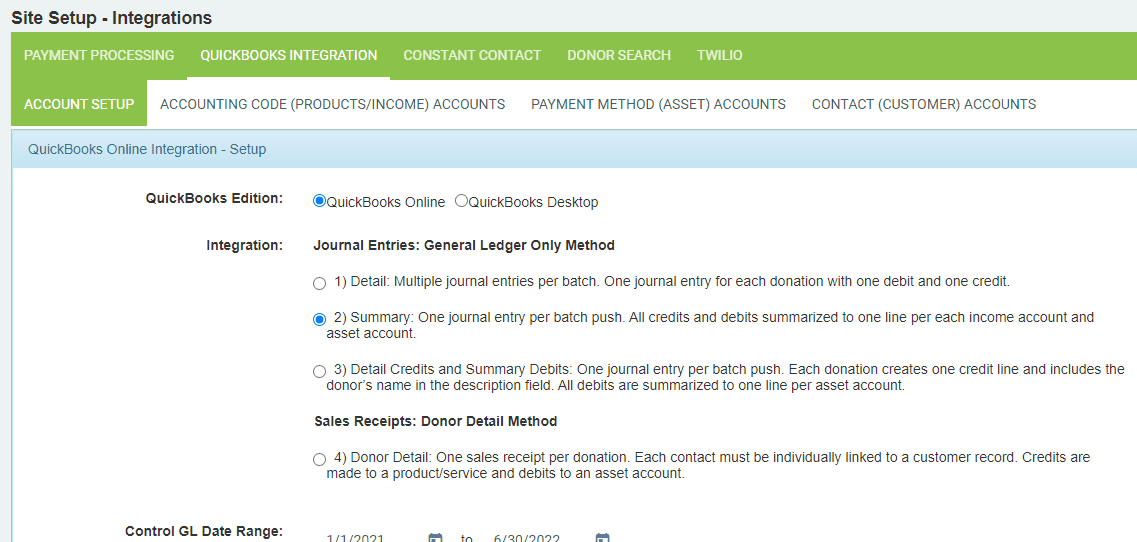

If you are using QuickBooks Online or QuickBooks Desktop (for PC), you can automatically integrate your transactions from DonorSnap to your QuickBooks general ledger for no extra cost.

- Log in to QuickBooks and authorize access to your DonorSnap account.

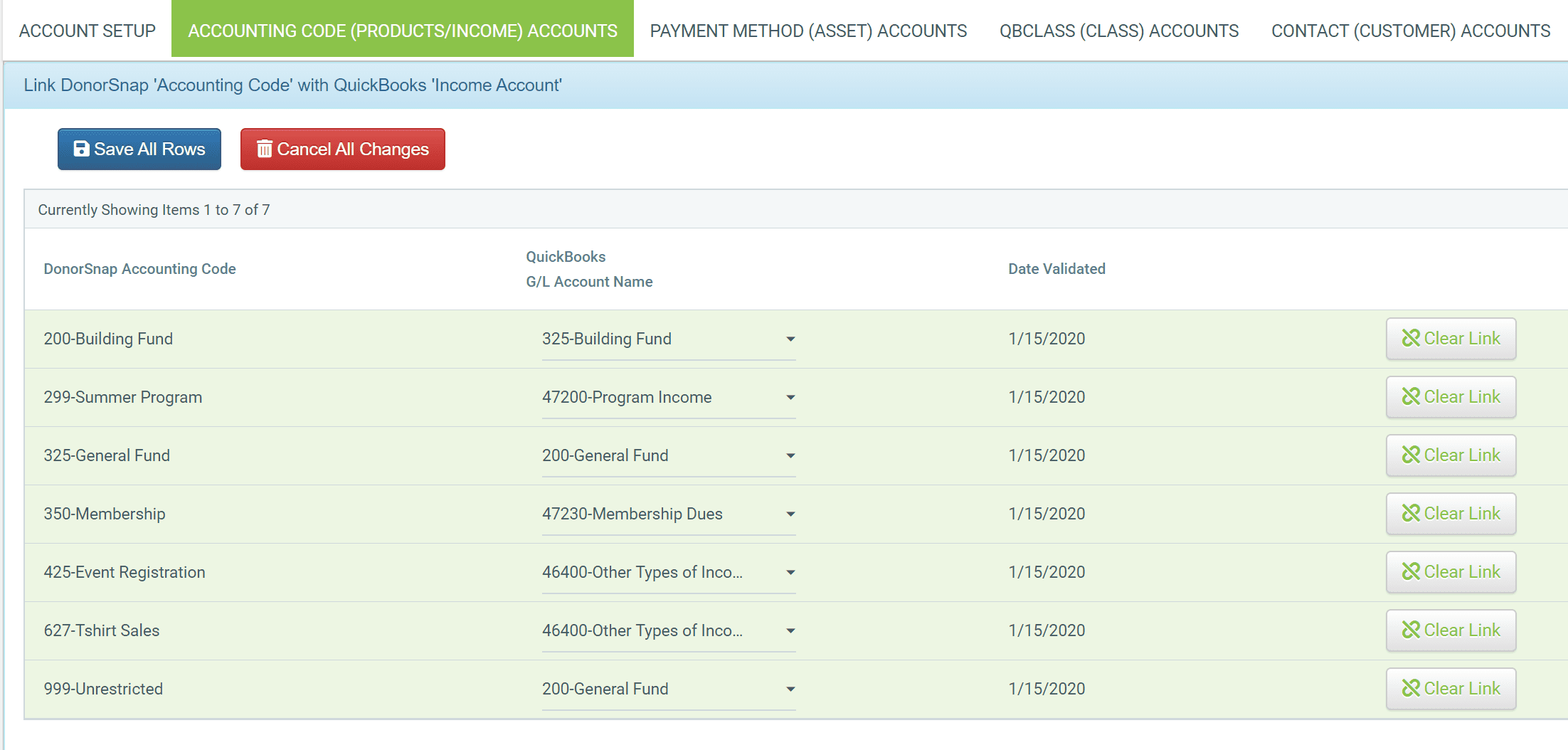

- In DonorSnap, match up your DonorSnap Accounting Codes with your general ledger income accounts.

- Match your DonorSnap Payment Method with your general ledger asset accounts.

Once these three steps are complete, you can begin sending your transactions to QuickBooks.

There are multiple integration methods available. For more details about how the integration works, please view the QuickBooks Online Integration Guide or the QuickBooks Desktop Integration Guide.

Optional: Link customers with contacts

For those that want to keep detailed transaction information for each donor within DonorSnap and QuickBooks, you can link individual contact records with your QuickBooks customer accounts. QuickBooks customer codes can be added one at a time or imported using our Excel Import tool.

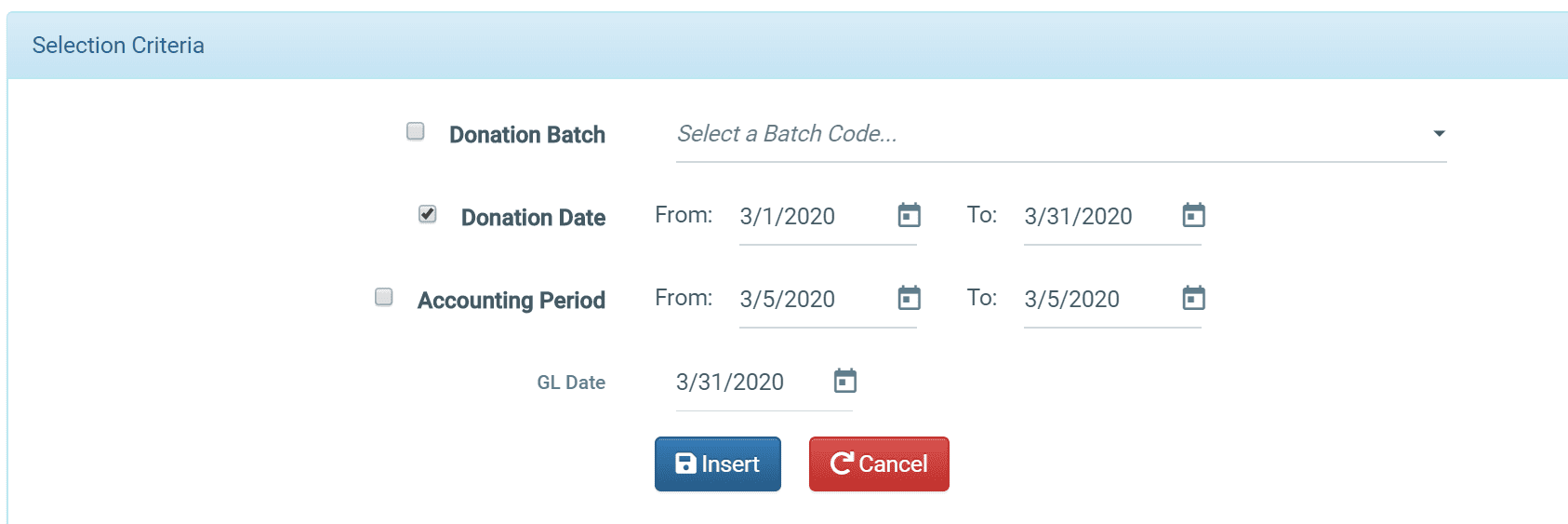

Send a batch to QuickBooks

Now that your two accounts are linked, you can easily send batches of your transactions to Quickbooks. Start by selecting which transactions you would like to include. Next, assign a date that you want them to be posted under. Don’t worry about accidentally adding duplicates to QuickBooks. Safety measures within DonorSnap prevent a single transaction from being transferred more than once.

Accounting Reports for Manual Summary Entry into Any Accounting Software

Reconcile all donations with any accounting software in a flash. Never do duplicate entry again.

Use the Right Tool

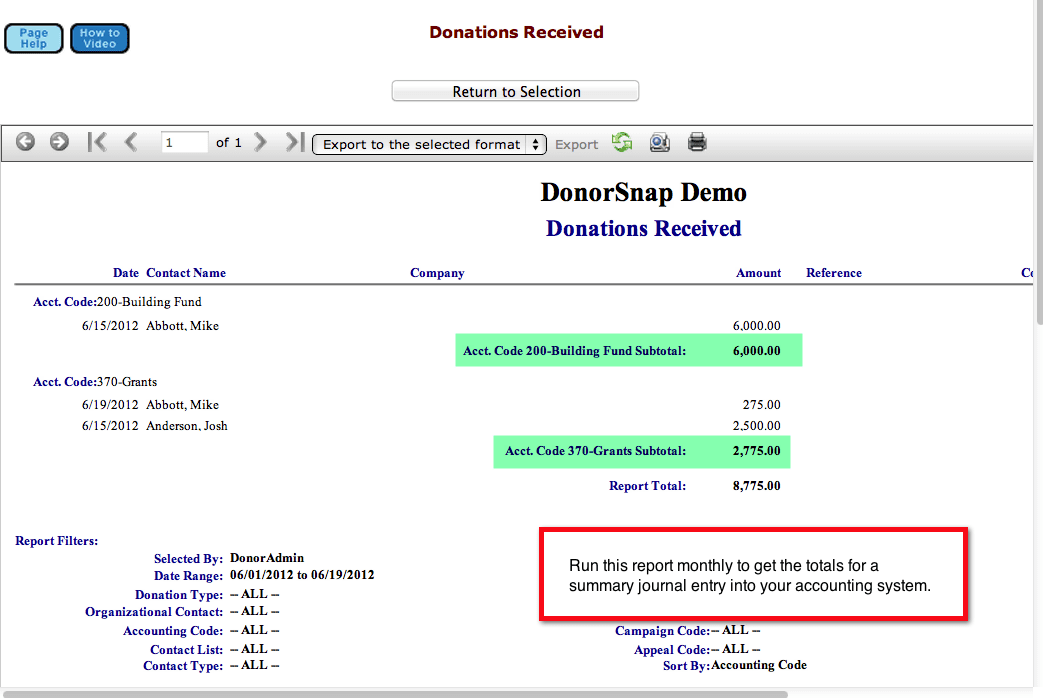

Your accounting software was never meant to be a donor management system and DonorSnap isn’t meant to be an accounting software package. Each one has a specific function and, with the exception of recording total donations, they are mutually exclusive. Your accounting software needs to know how much was donated to the organization and probably the category (accounting code) of the donation. DonorSnap acts as your “subsidiary ledger” (a term that your accountant will understand) to keep track of the details regarding who gave the donation and when. If you utilize the DonorSnap donation report to update your accounting records (monthly, quarterly or annually depending on your accountant) the two systems will be perfectly in sync.

Donations Accounting Report

This is a standard DonorSnap report that will categorize the donations received for a specific period of time based upon the accounting code entered with the donation. This report is all your accountant needs to make a journal entry into your accounting system to record your total donations for a period of time. If in the future, someone wishes to see the details of the journal entry, they can review a saved copy of the report (it should be attached to your journal entry for proper support) or visit DonorSnap and rerun the report.